Why I avoid: Apollo Food Holdings?

Why I avoid: Apollo Food Holdings? Company Introduction

Apollo Food Holdings Berhad is listed in Bursa Malaysia Main Board. The Company's wholly owned subsidiaries include Apollo Food Industries (M) Sdn Bhd and Hap Huat Food Industries Sdn Bhd. Apollo Food Industries (M) Sdn Bhd is engaged in manufacturing of compound chocolates and chocolate confectionery products and cakes. Hap Huat Food Industries Sdn Bhd distributes and markets compound chocolates and chocolate confectionery products and cakes.

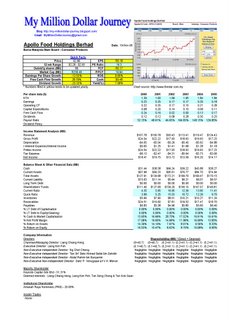

1. Declining earnings

Apollo has been profitable since its listing in 1997. It thrived in its early years from '97 - '02 as revenue almost doubled from RM55m to RM 100m while its earnings after tax grew 43% from RM14m to RM20m. However, its performance has been lacklustre thereafter though its revenue continued its uptrend from RM100m to RM124m from '02-'05, its net profits dropped from RM20m to RM 14m.

2. Inability to raise prices amid inflation

Not only has the company failed to increase its earnings in tandem with its revenue, earnings has dropped. In its latest Annual Report, its chairman has cited increased raw materials as reason for its decreasing profit margins. Profit margins have almost halved from its high of 25% in 1997 to its current 14%. The entry of other products of similar nature from local and overseas manufacturers has posed a threat to Apollo. Fierce competition has suppressed its ability to raise prices. Looking forward, even increasing topline will not translate into satisfactory bottomline.

3. Investing in quoted securities

Apollo has a history of making investments in Bursa Malaysia quoted securities since 2001. Generally, I would avoid companies that invest in area outside their circle of competence. In this context, Apollo is an expert in making compound chocolates and chocolates confectionary products and cakes. Its founder has more than 30years of experience in this industry. Why does it venture into areas as diversify as banking, construction and gaming? What do these and chocolate cakes have in common?

Of course there are succesful examples where companies invest in areas outside their core business and yet still thrive. Remember the textile company that invest in industry as diversify as insurance, furniture, utilities, chocolates, newspapers and etc yet prospered? Of course that is helmed by none other than Warren Buffett, the greatest investor of all time. He has outperformed the market with more than 22% ROI per year over the past 37 years!

Now back to Apollo, let's see how its investments performed:

2001: Invested RM 3.13M, lost RMo.14M

2002: Invested RM 0.27M, gained RM0.01M

2003: Invested RM10.60M, lost RM0.67M

2004: Invested RM 1.49M, gained RM0.29M

2005: Invested RM 8.80M, lost RM0.83M

Total= lost RM1.34M

The above gain/losses are before the costs of money. Assuming 4% risk free bank interests. Total investments of RM 24.29M over 5 years, company has forgone interests earnings of RM 1.00M. Therefore, the total losses includes interests are RM 2.34M!

Why would the management spend 5 years of effort making these investments that resulted in losses and distracted them from the day to day operation of making chocolate cakes?

4. High capital expenditures over operating cash flow

If a company needs to use RM1 of capital expenditure to generate RM1 of earnings, then effectively it doesn't generate any value. Earnings is an important yardstick to value a company, however it is equally important to look at its capital expenditures to see how much cash could the company keep from the earnings it makes.

Throughout the past 6 years, Apollo's capital expenditures range from RM0.08 - RM0.20 per share (see table above) while its operating cash flow range from RM0.15 - RM0.35. The average capital expenditures is roughly 50% of earnings. In the other words, out of every RM1 it earns, it needs to spend RM0.50 to maintain the plants and equipments. Comparing with Eurospan Holdings which requires RM0.25 for RM 1 it earns, Apollo capital requirements is high.

5. Valuation

It curently trades at 16xPE and 17xFCF. With its earnings dropping year to year over the last 4 years, it is surprising to see it being valued at this price. In my opinion, at its current valuation investors can acquire other more stable businesses aka 'blue chips' that grow at a reasonable rate of 15% per year. Just to name a few, eg. YTL Power-12.5xPE, CAGR=15%(over last 5 years); QL Resources-11.3xPE, CAGR=20%(over last5 years).

Disclaimer: This report is provided for general information only, is not to be considered as investment advice and should not be relied upon for investments decision. Visitors please exercise your own judgements for investments decision.